There is a lot of preamble (summary to date) in this post, and if you have been fully keeping up here and on LinkedIn, click here to skip it.)

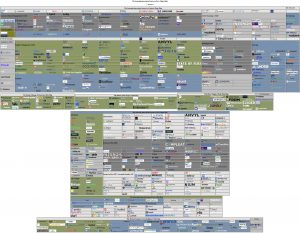

Last Wednesday (2024-04-17) the doctor released the Sourcing Innovation Source-to-Pay+ Mega-Map which presented a new and improved mega version of the logo maps (with 666 distinct logos for your viewing pleasure) that are becoming all too common in the space where:

- every vendor was verified to be in operating AND offering their solution (as of 2024-04-13)

- every vendor is clickable (so no more deciphering runic logos, 4 pt font, or which vendor among 3+ similar vendors is actually being referred to)

- every vendor is mapped to the closest standard category/categories (where the core categories have been defined repeatedly on this blog, see, for example, this series)

The reason the doctor created this massive Mega-Map (despite disliking, and sometimes detesting, them), is because it was the only way he could educate you on all the flaws (making even his map useful ONLY if you plan on using it as clickable desktop wallpaper); these flaws include the flaws referenced above (corrected in the SI map), but also include these flaws (and this list is NOT exclusive):

- these logo maps are nowhere near complete; (many maps to date have only captured 1/10 to 1/7 of the space)

- the landscape changes DAILY (vendors come and go)

- the vendors are only comparable at a minimal baseline, which is generally not enough to satisfy any company, IF they are comparable at all

- the majority of vendors with comparable solutions are still NOT relevant for you

After this explanation, he went into a big rant on how, Like Analyst Firm 2*2s, Random Logo Maps are NOT Appropriate for Tech Selection! The reason for this rant was because these maps are not only being presented by some parties as proof they have what it takes to do your tech selections, but they are being used by Procurement organizations and overworked consultancies as a foundation for vendor identification for Tech Selection. This is scary when you consider all of the flaws outlined above, and the utter lack of knowledge it conveys on how to do identify the right vendors for a tech selection RFP and short-list.

For a high level outline on what is need for a tech selection, we refer you back to the linked article as well as the follow up article on why Firms that Rely on Logo Maps and Analyst 2*2s for Tech Selection are NOT Appropriate for Tech Selection (Either)!

The only point I will emphasize is you have to know the space well, and most clients are lucky if the consultancy has more than half a dozen to a dozen partners (i.e. the same old, same old mega-vendors they recommend day-in and day-out because they see it as too much work or not profitable enough for them to actually identify, research, and/or keep up with smaller, best-of-breed vendors, even though this thinking means that, like many Execs that started in the late 80’s, they are just taking their turn to Walk the Dinosaur and will soon go the Way of the Dodo because, as THE PROPHET has decreed in Prediction No. 9, the day is coming fast when SaaS[+IP] Management Solutions [will] Start to Eat Services Procurement — and this includes tech selection!)

This should be expected as even most analysts don’t know more than a few dozen of the same-old, same-old solutions that they spend the majority of their time on every year (as some firms ONLY cover paying clients and/or ONLY include paying clients in their map) as they need to spend a lot of their time keeping these high paying (usually 6 figure) clients happy as well as taking the CPOs who pay for research subscriptions happy with advisory services.

Furthermore, when you consider the number of analysts left in the space who have been covering the Source-to-Pay space consistently for more than a decade, those are few and far between. Remember that Duncan Jones recently retired from Forrester, all those big names we know and love from Gartner (including the AMR names, as AMR was one of the firms that broke the space open before Gartner acquired them) are gone (from Gartner), Aberdeen was acquired by Harte Hanks, only Chris Sawchuk is left at The Hackett Group, which takes us to Ardent Partners, where we have Andrew Bartolini and Christopher Dwyer (who go back to the Aberdeen days), IDC, where we have Mickey North Rizza (who goes back to AMR and is one of the first to cover S2P), and finally Spend Matters where you have Xavier Olivera who hits the 10 year mark this summer, Jason THE PROPHET Busch, and Pierre Mitchell, one of the co-founders of S2P coverage from back when he was VP of “Supply Management” Research at AMR Research in 1999! (And yes, I know that Magnus Bergfors is at Ardent now, but he’s only at the 9 year mark as an Analyst due to his 2.5 year vendor break.) In terms of solo, you have Pete Loughlin who started Purchasing Insight in Nov 2013, Peter The Public Defender Smith who started Procurement Excellence in 2010, and Jon “The Revelator” Hansen who goes almost as far back as I do as an independent (and further with his industry experience), all the way to 2007, which is one year after the doctor started Sourcing Innovation in 2006. And that’s about it.

As a result, the analysts who have seen a considerable amount of vendors are few and far between. the doctor has already stated that the roughly 500 vendors he has reviewed as an analyst over the past 17 years (with over 350 covered publicly on Sourcing Innovation and Spend Matters) probably puts him in the top 3 analysts globally by vendor count, but as the Mega-Map has just proved, that would still only be half of the vendors in the space, if all of those vendors were still around today! (Some went out of business and quite a number were acquired; in the latter case, some of their solutions are still around with a new look and a new name, and others were sunsetted.)

Along with the Mega Map, these articles have generated quite a lot of commentary on LinkedIn, for example:

- You Want Logos? YOU WANT LOGOS? At Your Service! Here are 666 Unique Vendor Logos in (28) Source-to-Pay+ (Categories)!

- the doctor dislikes logo maps! So why did he create one?

- 𝐅𝐢𝐫𝐦𝐬 𝐭𝐡𝐚𝐭 𝐑𝐞𝐥𝐲 𝐨𝐧 𝐋𝐨𝐠𝐨 𝐌𝐚𝐩𝐬 and Analyst 2*2s for Tech Selection 𝐚𝐫𝐞 𝐍𝐎𝐓 𝐀𝐩𝐩𝐫𝐨𝐩𝐫𝐢𝐚𝐭𝐞 𝐟𝐨𝐫 𝐓𝐞𝐜𝐡 𝐒𝐞𝐥𝐞𝐜𝐭𝐢𝐨𝐧 (Either)!

But the chatter didn’t stop there. It just began. Joël Collin-Demers (Pure Procurement, who better have 512 vendors competing for the Procurement Cup next year) has doubled down on the need for digitization (although the doctor disagrees on the industries we need to start in) and Procurement Process Orchestration (which, alone, won’t save you), a cry also echoed by Jon “The Revelator” Hansen where he asked What is “Supply Chain Orchestration.

Preamble ends here.

However, it seems the doctor hit a few nerves with these posts (his favourite thing to do, because if you stop feeling, well, at best you’re paralyzed and, at worst, you’re dead) and Jon “The Revelator” led the charge (after waking from his chocolate-induced coma where he was consumed with solving the Chocolate Mystery)!

Basically, after catching up on the Mega-Map and the subsequent rants, he decided that we need to replace solution provider maps since many don’t even track the companies that have been serving the market for 20 or 30 years with a loyal client base in addition to all the new entrants not big enough (to pay them enough) to get coverage. He proposed we need a Draft Kings in our Space where each analyst picks, say, 10 providers to regularly cover (that don’t overlap those covered by other providers) (i.e. force each analyst [firm] to jockey for position to report on the same-old, same-old on the same top 10; of course, this would require vendors to play along, and analyst firms willing to give up that sizeable contribution they get from those big vendors, so it would only work if the vendor gave the ONE firm they selected an amount equal to all the money they used to split across firms to make up for all the vendors the firm lost). So while it may not be likely this will happen, it did lead to a great discussion on what an analysts (firms) responsibilities are and where the market might go. (Check the Comments in the linked post.)

But Jon “The Revelator” still couldn’t sleep. He was visited by the ghosts of accountability past, present, and future and had to ask should analyst performance be assessed by the successful implementations of the providers they list in their (Dynamic) Analyst Solution Map, where he assumed that, based on the prior discussions, analysts, and firms, should at least transition to a dynamic analyst solution map (because, among other things, it could revolutionize how we understand and engage with the (solution) landscape, which he feels is necessary based upon the high failure rates we still encounter in software/SaaS implementations [including AI, where 85% of projects are failing*]) and asked if analyst performance should be assessed by the successful implementations of the ten providers they list. (It’s thought provoking, and while the doctor agrees that they should be accountable for the accuracy and completeness of the coverage, since it is typically a consultancy or implementation partner doing the implementation, and not the vendor or the analyst firm, you can’t hold an analyst or their firm responsible for what is not under their control.)

But it also kicked off a great discussion about transparency, kicked off by yours truly and Dr. Thierry Fausten who agree that an analyst/consultant:

- should NOT recommend a solution they haven’t seen LIVE

- should NOT recommend a provider they haven’t engaged with in (roughly) the last year (or so, two years max)

- have deeper requirements for detailed ranking vs. just market positioning

- etc.

… and this led into a detailed discussion between us and James Mead about analyst requirements, and ethics, and disclosures in particular.

Some of us believe that an analyst:

- must publicly disclose any direct investments in the companies we cover (or significant indirect, e.g. > 5%, if we have self-managed 401Ks/SSIPs/RRSPs/etc.)

- must be willing and able to disclose any providers we are currently engaged with if asked (as this can’t necessarily be public if the project requires an NDA)

- must publicly disclose any vendors who give us referral fees or commissions on sales for referrals, as that could definitely bias us

As the doctor has already stated,

- he has no direct or significant investments in any companies in S2P+ as his goal was to be unbiased (at least from a financial perspective) since day one

- he will always disclose potential competitors he is currently engaged with if asked by a (serious) potential client

- he does not accept referral fees or commissions on sales from any vendors, and will not engage with a vendor who insists that is how they pay consultants/analysts

And he was glad to see that at least a few independent analysts are publicly speaking up and indicating they have the same beliefs. (Some do accept referral fees, but they publicly disclose on their website who their partners are that pay them such fees.)

However, there really hasn’t been a peep yet from any analysts at the big firms. Which leads the doctor to ask if the current analyst / consulting models are outdated, and maybe even unethical, especially since it is a rather well known fact by some that:

- one of the big analyst firms ONLY included paying clients in their 2x2s

- another of the big analyst firms rewrote their inclusion criteria on every iteration of their 2x2s so that the company size/revenue/geography/etc. requirements were the absolute minimum to include all of their paying clients [that they wanted included] while eliminating as many of their non paying clients as possible

- he’s been told by dozens of the smaller vendors he has been covering over the past year that two of the bigger analyst/consulting firms, in addition to the firm that has historically only included paying clients, will NOT cover them unless they pay for a write-up and research bundle that is in the 50,000 to 70,000 range!

All of this bothers him greatly. This is why:

- when he (co-)designed the Spend Matters Solution Maps back in the day, he did so on the condition that they were not pay-to-play, and any vendor who was willing to meet the requirements could be included (namely they must:

- complete the questionnaire in sufficient detail

- give us the live demo

- agree to be included in the publication regardless of how they score relative to other vendors [as it was a huge commitment of analyst time])

- he does not charge vendors for coverage on SI or the public to read the coverage; now, it’s true that these vendors may get more coverage from the firms charging them 50,000 to 70,000, but if the analyst is not a technologist by training and trade, the doctor doubts their coverage would be any better

(and yes, this does limit how many vendors the doctor can cover on SI as SI thus generates zero revenue, which is why, unless he decides the vendor has developed something substantially new, or the amount of coverage they need is too much for one article, he has a minimum of two years between successive coverage)

But he wants to know what you think about this, and what you think analyst (firm) and consultant responsibility should be. For example, maybe it’s okay that a firm only covers the vendors who pay them (especially if the firm switched to a Draft Kings model), but shouldn’t the firm at least publicly disclose that in a very easy to find manner, as well as minimum fee scales required for that coverage (and not just footnote it somewhere in the back page of a report you can’t even read unless you spend somewhere between 5,000 and 25,000 or find a vendor who sponsored the report who will give you a copy in exchange for your personal information and a forever subscription to their spam, err, mailing list)?

Anyway, the doctor can’t wait for the next article from Jon “The Revelator” Hansen and the discussion that it will hopefully kick-off. It will be interesting to see if we get anyone from the big analyst or consulting firms commenting or if they will (continue to) pretend that we just don’t exist …

* Ready to jump off that cliff-bound out-of-control bandwagon with no steering and no brakes yet?